EDUCATION PLAN

Educational planning is an absolute necessity because:

Proper academic planning saves time, attempt and money as planning in each subject is a time-saving, an effort-saving and a moneysaving activity.. Educational planning is a valid technique of fixing academic issues through avoiding the trial and error technique of doing things.

(1) It ensures success of the institution. It takes into consideration the important issues, conditions, constraints and factors in education. Its focus is on future objectives, vision and goals. It is proactive in nature in that it emphasizes perception and ability to apply theory and profit from it in advance of action.

It clarifies goals and the means to achieve those goals. Thus it eliminates trial-and-error process, reduces chances of failure and ensures success. In other words, it provides intelligent direction to activity.

(2) The scarcity of financial and other non-material resources poses a challenge to education. Planning is a response to such challenges and explores the possibilities of alternative uses and optimum utilization of limited resources.

(3) Effective and efficient planning saves time, effort and money.

(4) It is a co-ordinated means of attaining pre-determined purposes.

(5) Education is a public service demanded by the public and supplied by the government. For any government effort of such a large magnitude as education, planning is absolutely necessary.

A company typically makes these scheduled debt interest payments before they pay stock dividends to shareholders. Debentures are advantageous for companies since they carry lower interest rates and longer repayment dates as compared to other types of loans and debt instruments.

Education Investment Plan: Empowering Futures, One Instalment at a Time

Are you passionate about securing a brighter future for your loved ones through quality education? Our Education Investment Plan is crafted with simplicity and your aspirations in mind, ensuring a seamless path towards educational milestones.

Key Features:

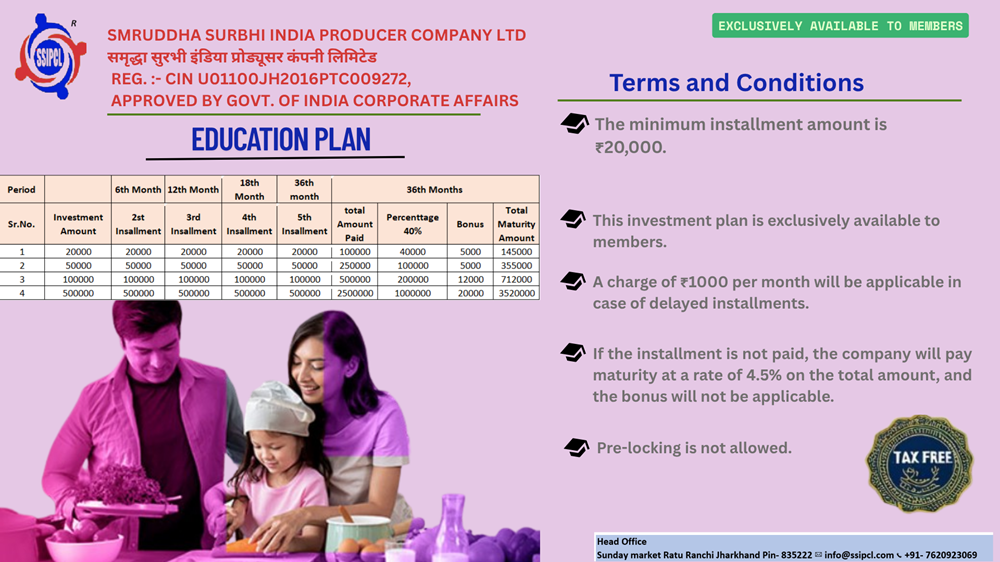

- Easy 5 Instalments: Simplify your investment journey with our easy 5-installment plan. Make contributions at your own pace, easing the financial commitment while securing a solid foundation for educational aspirations.

- Minimum Investment: Begin your educational investment with a modest commitment of just ₹20,000. We believe in making quality education accessible to all, starting from a manageable entry point.

- Duration of 36 Months: Secure your education plan for a dedicated period of 36 months. This timeframe provides a structured and goal-oriented approach, aligning with academic milestones and financial planning.

- Bonus Rewards: As a token of appreciation for your commitment, enjoy bonus rewards that enhance the overall value of your investment. These bonuses are designed to complement your efforts in securing a robust educational fund.

- Flexible Withdrawal Options: Life is full of surprises, and our plan recognizes that. Enjoy the flexibility of withdrawing a portion of your investment in case of unforeseen circumstances, ensuring that you can adapt your financial strategy as needed.

- Transparent Progress Tracking: Stay informed about the progress of your investment with transparent and regular updates. We believe in keeping you in the loop every step of the way, fostering trust and confidence in your educational investment.

How to Get Started:

Embark on your educational investment journey with these simple steps:

- Visit our website or connect with our dedicated customer service team.

- Complete the straightforward application process, providing essential details and selecting your initial investment amount.

- Choose the 36-month duration option and opt for the easy 5-installment plan.

Investing in education is an investment in the future. Secure the academic journey of your loved ones with our Education Investment Plan, where simplicity meets purpose.

As with any investment, it’s advisable to thoroughly understand the terms and conditions, consider seeking professional advice, and ensure that the chosen plan aligns with your unique financial goals.